Introduction

The main issue at stake in The BNP Case—brought before the courts by Les Amis de la Terre France, Notre Affaire à Tous, and Oxfam France—is to demand that the bank immediately cease ALL financial support for fossil fuel developers, i.e. companies planning new oil and gas projects.

Through its latest announcements, which we analyze below, BNP Paribas seems to acknowledge, at least on the surface, what NGOs have been repeating and arguing all along: when the bank grants new “general” financing or investments—i.e. not earmarked for a specific activity or project—to a company developing new oil and gas projects, it contributes to the expansion of fossil fuels, which is incompatible with the goal of limiting global warming to 1.5°C and with international standards.

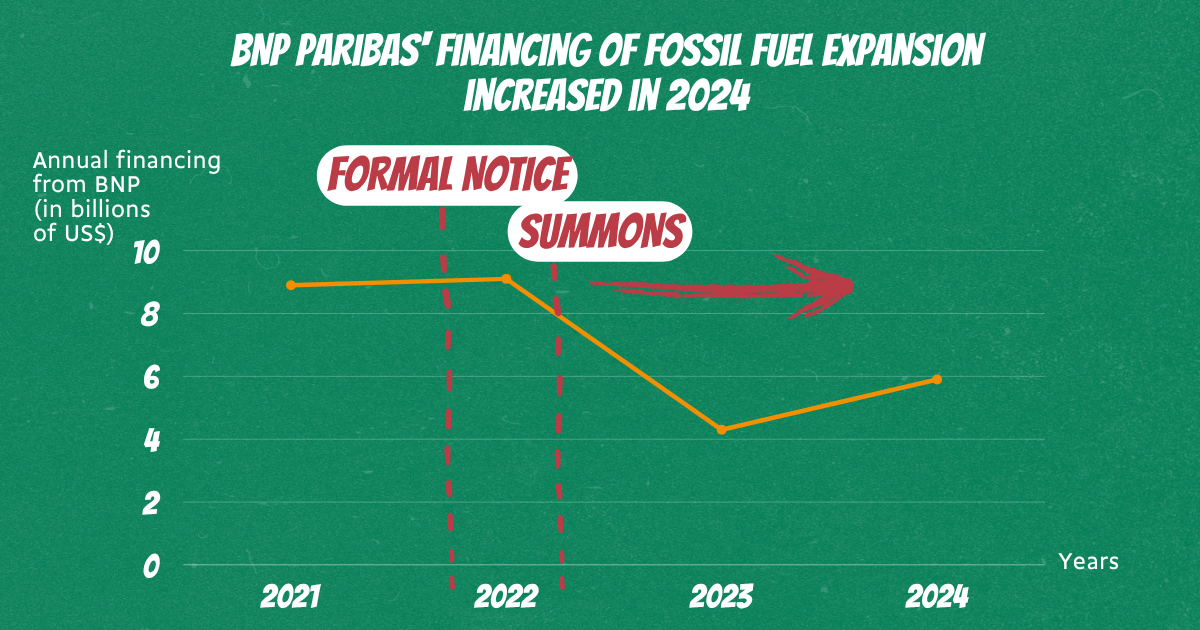

However, when the organizations behind The BNP Case say that these changes in BNP Paribas’ practices are insufficient, it is not nitpicking. Indeed, one important fact is clear: BNP Paribas’ financial support for the expansion of fossil fuels increased in 2024 compared to 2023 (1).

Admittedly, BNP Paribas has made a number of commitments since we began our legal action three years ago and thanks to public pressure, which may give the impression that it recognizes the need to reduce the use of fossil fuels.

However, in this article we highlight the many “loopholes” in its policy, which in reality still allow BNP to participate in the climate-damaging activities of fossil fuel developers (recently Saudi Aramco and Equinor) and to fail to meet its climate obligations. Three years after the launch of the legal action, we analyze BNP’s evolution in terms of climate commitments.

In 2024, a worrying increase in fossil fuel financing

According to the international report Banking On Climate Chaos published in June 2025 (1), BNP Paribas performed worse in 2024 than in 2023, granting $5.9 billion in financing (loans, share and bond underwriting) to fossil fuel developers, a worrying increase of 37%. The bank thus retains its position as France’s leading supporter of fossil fuel development. Between 2021—the year it promised to achieve carbon neutrality by 2050—and 2024, BNP granted $28.3 billion in financing for expansion.

In particular, it continues to financially support expansion through new loans to companies opening oil and gas fields. The bank granted loans to eight developers in 2024 (1). Among them are multinational corporations particularly known for the threat they pose to the climate. For example, in 2024, BNP made a loan to Equinor. This Norwegian major, which in particular exploits offshore oil and gas in the vulnerable marine environment, announced in February 2025 that it was scaling back its ambitions in renewable energies and increasing its hydrocarbon production.

Some progress in three years, but still not enough

In the three years since we launched our legal action in October 2022, BNP Paribas has announced changes to its policies and practices in the energy sector. The bank announced in May 2024 that it would no longer underwrite new conventional bonds for companies active in oil and gas production through its subsidiary BNP CIB, and then committed to no longer investing in such bonds in December 2024 through its asset management subsidiary BNP AM, and then through its insurance subsidiary BNP Cardif in April 2025.

The energy deployed over the past three years by The BNP Case and the pressure exerted by civil society—students, climatologists, economists, activists, etc.—have pushed BNP to make these commitments, which have resulted in a reduction in the bank’s exposure to fossil fuel expansion in 2023 and 2024 compared to the period 2016-2022 (1). In 2021 and 2022, BNP injected $9 billion into companies developing fossil fuel projects. After we began legal action at the end of 2022, this figure was halved in 2023.

The constant reminder of the bank’s toxic links with one of the biggest contributors to the climate crisis, TotalEnergies, bore fruit in 2024, when BNP Paribas provided no financing to the company, according to the available data (5), whereas the bank was its leading financial partner in 2021 and 2022 (2).

However, its financial support for fossil fuel expansion increased in 2024 compared to 2023, and there are still many shortcomings and questions. How is this possible? What can we expect in the coming years? Why is BNP not really following the recommendations of scientists?

Persistent gaps in BNP Paribas’ policy

The latest announcements from BNP Paribas highlight a glaring lack of consistency: the bank applies double standards between its different activities.

Firstly, has BNP Paribas stopped granting new loans to companies planning new oil and gas projects? The answer is no. In fact, it refuses to apply to its lending activities what it claims to apply to its bond underwriting and purchasing activities.

The same goes for share underwriting and purchasing activities, which are not covered by BNP Paribas’ oil and gas producer exclusion measure. In 2024, for example, it participated in the underwriting shares for Saudi Aramco (3), the company planning the largest expansion in oil and gas fields in the short term.

Finally, all of the commitments made by BNP Paribas for its various branches over the last three years only concern upstream oil and gas exploration and production activities. It leaves out many activities that take place throughout the fossil fuel supply chain, which contribute to encouraging the expansion of the sector and generate serious greenhouse gas emissions. This is particularly the case for new liquefied natural gas (LNG) terminals, which have no place in the International Energy Agency’s scenario for carbon neutrality by 2050 (4). These terminals are essential to the global supply of LNG, as they enable gas to be liquefied for transport by—known as LNG carriers. For example, BNP Paribas recently granted new support to the American group Sempra, a key player in LNG and shale gas export from the United States.

As a result, although BNP may appear to have been following certain scientific recommendations since the start of the case, in reality it has been moving very partially, which is very worrying.

In short, as long as BNP does not make commitments that truly reflect science, it will continue to use our money to enable the development of new climate-killing projects.

A worrying dilution of its responsibility

Finally, another worrying trend has been observed over the past three years, coming from BNP Paribas and in particular its investment banking arm (CIB). BNP has made several new announcements—mainly in response to questions from The BNP Case at the bank’s successive general meetings—that the group has not yet translated into firm policies or in its vigilance plan.

While BNP usually uses its sectoral policies to officially confirm the exclusion of certain polluting clients, its oil and gas sector policy has not been updated since May 2023 and still does not provide for an end to bond underwriting to fossil fuel producers. In response to our questions on this point at its 2025 annual general meeting last May, the bank explained that this decision was simply a “managerial act,” an internal decision, in short, “which does not need to be incorporated into a policy.” A month later, the Banking On Climate Chaos report revealed that in 2024, BNP Paribas participated in a bond underwriting for the Emirati company Abu Dhabi Developmental Holding Company PJSC, which plans to develop new oil and gas reserves in Canada and the Netherlands.

The climate duty of vigilance of the European Union’s first bank cannot, of course, be based solely on internal decisions, which BNP could potentially reverse. It is a worrying sign and calls into question the bank’s responsibility to its investors and the society in general. Furthermore, BNP Paribas must not treat climate change as merely an adjustment variable in its financial risk assessments. On the contrary, it must take into account the material impact of its activities on the climate, in a change of practice that is truly aligned with science.

Conclusion/summary

The overwhelming majority of BNP’s financing for upstream oil and gas expansion in 2024 was provided through general loans.

As we have repeatedly stated, we cannot be satisfied with the bank’s declarations of intent to gradually reduce these loans.

- BNP must commit to immediately and permanently ending all lending to expansionist companies.

- BNP must take into account the rest of the expansion value chain. This must include midstream activities—transportation and storage—and more specifically LNG developers.

BNP Paribas has a chance to emerge as a leader on climate change and encourage all players in the financial sector to make the shift necessary for the energy transition.

| If the mobilization of the civil society and the repeated calls of the scientist community fail to get BNP to change course in the coming months, the bank will have to answer for its actions in court in “The BNP Case” trial, whose first hearing is expected in 2026. We will not give up! It is illegal for such a major global bank to finance new fossil fuel projects, thereby condemning our future and endangering the living conditions of billions of people, and we will make sure everyone knows it! |

You can also find a detailed analysis of the various gaps in BNP’s developments by following this link:

Sources:

- Reclaim Finance, RAN, Banktrack & co (2025) Banking on climate chaos.https://www.bankingonclimatechaos.org/wp-content/uploads/2025/06/BOCC_2025_FINAL4.pdf

- Reclaim Finance (2025) BPCE becomes TotalEnergies’ leading bank in 2024. https://reclaimfinance.org/site/2025/04/10/bpce-devient-la-premiere-banque-francaise-de-totalenergies-en-2024/

- Reclaim Finance (2024) Sale of Saudi Aramco shares: a financial service to avoid. https://reclaimfinance.org/site/2024/06/21/vente-dactions-de-saudi-aramco-un-service-financier-a-eviter/

- Reclaim Finance (2025) LNG: a climate bomb massively supported by banks and investors. https://reclaimfinance.org/site/2024/06/21/vente-dactions-de-saudi-aramco-un-service-financier-a-eviter/

- This refers to syndicated loans and bond and share underwriting. Bilateral services are not published because said to be subjected to banking secrecy, so NGOs do not have access to this information, which creates an underestimation of the problem.